Recommerce Market Size and Billion Dollar Opportunities for Brands and Startups

While it might seem intuitive to link the surge in recommerce solely to sustainability concerns, the reality is more complex. Yes, environmental factors like waste reduction and recycling are crucial, but there’s a deeper driver at play.

Today’s younger generation faces pressing budgetary constraints, and this, in tandem with the surging popularity of sustainable choices, has catapulted recommerce from a mere cost-saving strategy to a fashionable trend.

It’s a potent mix of two powerful motivators: economic necessity and the desire to claim the social status of being environmentally responsible.

These strong drivers have created an industry on the verge of explosive growth.

The recommerce industry is anticipated to hit the $245 billion mark by the end of 2024. Investors are actively pursuing recommerce startups with an appetite for innovation. Simultaneously, brands are integrating recommerce at an astonishing rate. Given the intertwined economic and environmental advantages, the appeal of recommerce is undeniably vast and impossible to sideline.

Table of Contents:

- What is Recommerce

- Types of Recommerce Models

- Consumer Perspective on Recommerce

- Opportunity for Brands in Recommerce

- Brands with Active Recommerce Program

- Opportunities for New Startups

- Challenges and Concerns in Recommerce

- Tech Solutions that Enable Recommerce

- Is It Really Sustainable?

- What The Future Looks Like?

- Conclusion

What Is Recommerce?

Recommerce, at its core, is about breathing new life into products. Instead of an item gathering dust or heading to the landfill once its initial owner is done with it, recommerce ensures that the product continues its utility journey with another owner. This doesn’t just reduce waste; it promotes sustainability by saving on the carbon footprint associated with manufacturing new products.

The concept of recommerce isn’t some trendy, new-age invention. In fact, it’s been a part of human society for ages. Think about it: haven’t we always had places like thrift stores, flea markets, and even garage sales? And, in the digital era, platforms like Craigslist and eBay have been facilitating the resale of items for years.

So, you might ask, why is recommerce suddenly the talk of the town, experiencing unprecedented growth? A big part of its newfound popularity is the global push towards sustainability and conscious consumerism. But there’s more to it.

A new breed of specialized businesses has sprung up, delivering a top-tier experience for both sellers and buyers of pre-owned items. Their vision for the potential of recommerce has been contagious, drawing in established brands, that recognize their customers’ appetite for quality second-hand items and are diving headfirst into the re-commerce wave, aiming not just to ride but to steer and profit from these transactions.

While traditional recommerce was rooted in physical venues and thrift stores, today’s digital innovations have transformed the landscape. The mission? To make recommerce as fluid as possible.

Recently, we had the privilege of engaging with a trailblazer in this arena, Niall Murphy, founder of Evrything, the IoT Smart Products Platform championing Product Digitization – a pivotal tech that fine-tunes the re-commerce chain.

Our insightful exchange with Niall spanned for an hour. You can catch the entire podcast here:

This blog post, also available in a compact report, offers a comprehensive exploration of recommerce, highlighting current opportunities, outlining challenges, and spotlighting businesses leading the charge. Click here to download the report.

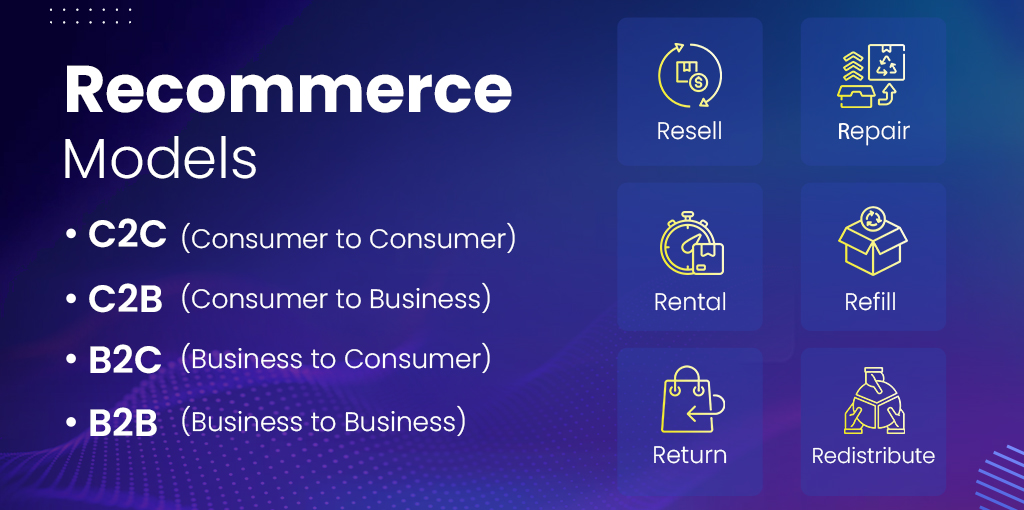

Types of Recommerce Models

Recommerce is more than just buying second-hand now. Today, it encompasses a range of business models, each driven by different activities but all aiming for the same goal.

- Resell: Selling pre-owned items to new owners.

- Repair: Fixing and refurbishing products to extend their lifecycle.

- Rental: Leasing items for a specific duration, after which they are returned.

- Refill: Replenishing products, particularly consumables, in original or alternative containers.

- Return: Sending back unwanted items post-purchase, often facilitated by businesses that then resell these.

- Redistribute: Shifting goods from areas of surplus to areas of need or demand, either within markets or between them.

Amid these activities, different transaction models have emerged:

- C2C (Consumer to Consumer): This model involves transactions between individuals. Think of platforms like eBay or Craigslist where consumers sell directly to other consumers.

- C2B (Consumer to Business): Here, individual consumers sell their products to businesses. For example, consumers selling their used smartphones back to tech companies.

- B2C (Business to Consumer): Traditional retail model wherein businesses sell directly to consumers. In recommerce, this often involves businesses selling refurbished or second-hand items to consumers.

- B2B (Business to Business): Businesses selling to other businesses, which might involve bulk sales of refurbished items or resale platforms catering specifically to business needs.These also include software tools and hardware that enable the recommerce transaction.

Read more: A B2B Sales Guide: How To Successfully Sell Your B2B Services

Consumer Perspective on Recommerce

Ultimately, it’s consumer demand fueling the explosive growth in recommerce. To truly understand this surge, we must delve into the underlying motivations of consumers. By doing so, the astounding rise of recommerce will make sense and also resonate logically with us.

Economic Considerations

Today’s younger generations, especially Gen Z and millennials, face a tighter financial squeeze than their predecessors.

For them, recommerce isn’t just a choice—it’s an economical and sustainable solution that aligns with their values.

In fact, according to the study by Offer Up, 78% shop secondhand in pursuit of a bargain, 58% aim to sidestep the steep prices brought on by inflation, and 34% are driven by a desire to maintain their preferred lifestyle within budgetary confines.

The New Social Currency

Times are changing, and so are our values. Owning brand-new items is losing its sheen. In its place, recommerce stands tall as a testament to environmental responsibility and heightened awareness.

A 2023 report by OfferUp indicated that a whopping 85% of consumers are engaged in buying or selling secondhand. The acceptance of secondhand shopping is also growing, with 76% of American shoppers feeling the old stigma diminishing. What’s more, 41% view buying secondhand as a genuine status symbol. A study by First Insight revealed that 62% of Gen Z and Millennial shoppers are inclined towards sustainable brands. Another study by eBay revealed that sustainability is deemed crucial by 39% of Millennials and 36% of Gen Z, compared to 26% of Boomers.

Opportunities for Brands in Recommerce

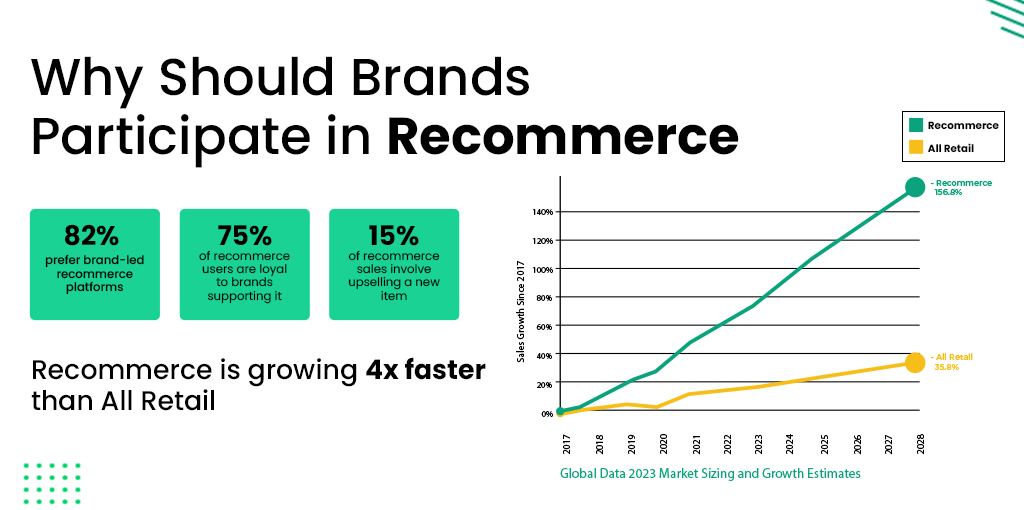

Why is recommerce a significant avenue for brands? Let’s dive deep into the compelling reasons:

- Ownership of the Full Product Lifecycle

It’s evident that consumers are already active in recommerce on platforms such as eBay. They’re buying brand items secondhand, and original owners are passing these products onto new hands. The key question for brands is – why remain a spectator?

Brands stand to benefit by diving into the recommerce arena, tapping into opportunities not just at the initial sale, but throughout the product’s lifecycle.

- New Customer Acquisition

Recommerce opens the door to a segment of customers who might find certain products beyond their current financial reach. These very individuals, when introduced to the brand, could be the loyal customers of tomorrow.

When Lululemon rolled out its ‘Like New’ program, analysts called it a brilliant move and its stock rose up 2.9% as a result of this.

- Turning Returns into Assets

Historically, returns and the complexities of reverse logistics have drained brands, especially in markets where size discrepancies are rampant. With the recommerce model, brands can now recover the costs of returns, efficiently manage inventory, and even tap into newer customer demographics. In doing so, they’re not leaving any money on the table.

- Controlling Overproduction

As Karin Dillie from Recurate puts it, “Brands don’t have to overproduce.” They have the leverage of balancing demand with resale.

- Loyalty and Retention

A whopping 75% of recommerce participants claim they’re more loyal to brands that facilitate recommerce. Moreover, half of these recommerce shoppers are repeat customers within a month, making frequent purchases and adding more to their carts.

- A Unique Upselling Avenue

Brands have a golden opportunity here. A notable 15% of recommerce sales also include a brand-new item. This shows the potential of upselling within the recommerce framework.

- The New Vendor – The Customer

Brett Wickard, CEO of FieldStack, explains the benefits of leveraging a resale strategy and treating your buyback program as a vendor opportunity.

“Imagine a magical vendor who delivers products into your stores for free. This vendor allows you to only buy the products you want — items that have proven appeal and will excite other customers. What’s more, you get to name the price. Finally, once you complete a transaction that benefits both parties, the vendor enters your store as a customer and buys more items!”

Brands with Active Recommerce Programs

The trend of brands adopting recommerce is gaining momentum at an impressive rate. From just 36 brands with resale channels on their ecommerce store in 2021, the number surged to 124 in 2022 and touched 149 by 2023, marking a staggering growth.

A notable report by Recurate showed that a whopping 82% of recommerce enthusiasts prefer purchasing from brand-led recommerce platforms.

Here’s a snapshot of brands and their recommerce programs.

Build your own re-commerce platform with a top-notch e-commerce development company.

Peer to Peer

Steve Madden Rebooted has developed a system allowing customers to easily list their items using original product details and images, ensuring a smooth selling experience that still embodies the brand’s essence.

Imperfect Inventory & Returns

Ministry of Supply’s Infinity Resale program revolves around reselling returned items or inventory that didn’t make the cut as new. It offers customers certified items at reduced rates, promoting participation in the circular economy.

Take-Back & Trade-In Programs

- Tech giants like Apple and Canon have trade-in systems that offer credit for used products towards new purchases

- Retail leaders, including Amazon, Best Buy, and Target, present trade-in options for a diverse range of items, from electronics to car seats

- Clothing brands like REI, Patagonia, Levi’s, and North Face encourage consumers to resell or donate gently used items

- Mobile carriers such as Verizon, AT&T, and T-Mobile propose trade-ins for devices and wearables

- Another Tomorrow uses a digital ID in each product, easing the resale process for customers

- Ikea expanded its Buyback & Resell program across several countries, offering store credits for used items.

- Eileen Fisher reuses, repairs, and repurposes bought-back clothes via its Renew program

- Farfetch initiated the Farfetch Fix repair program in collaboration with The Restory.

Branded Recommerce Channels

- Misha & Puff reclaimed its audience by launching a branded recommerce platform.

- Mara Hoffman’s Full Circle was developed to prolong garment lifespans and incentivize sustainable practices.

- Frye, renowned for its durable leather goods, introduced a recommerce platform to uphold its brand legacy.

- Peak Design aimed at simplifying and optimizing resale for their consumers.

- Levi’s Secondhand merges the buy-back and resale world, enhancing the brand-customer bond.

- Net-a-Porter and Lululemon have all collaborated with startups to streamline their recommerce ventures.

Opportunities for New Startups in Recommerce Tech

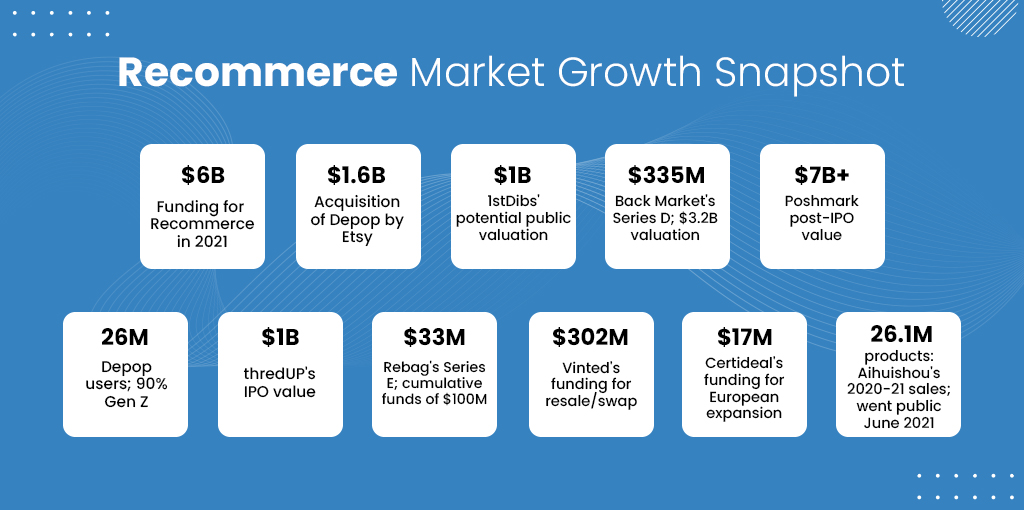

With a slew of stylish exits and record funding deals, it’s evident that recommerce is getting VCs fired up. Here’s a snapshot, with key figures and growth stats highlighted for quick reference:

Market Growth Snapshot

- $6B in funding for the recommerce sector in 2021

- Etsy acquired Depop for $1.6B

- 1stDibs, a luxury furniture recommerce website, potentially going public at a $1B valuation

- Electronics marketplace, Back Market, secured a $335M Series D, reaching a $3.2B valuation

- Poshmark’s valuation soared past $7 billion post-IPO

- Depop boasts 26 million buyers and sellers, with 90% being Gen Z

- thredUP made a public appearance with a successful IPO valued at $1B

- Rebag secured $33M in its Series E round pushing its total funding to $100M

- Lithuania-based startup, Vinted, known for resale and item swapping, amassed $302M in funding

- Armed with a Responsible Recycling certification, Certideal recently raised $17M for European expansion

- Aihuishou, a Chinese titan in the used electronics arena, marked the sale of 26.1M products between March 2020-2021 and celebrated its public debut in June 2021

A Plethora of Avenues

Startups need to realize that recommerce isn’t monolithic. There are three principal areas ripe for disruption

Managed Marketplaces: These are platforms that offer a controlled environment for buying and selling, ensuring quality and authenticity.

Enabling Tools and Software: With the surge in recommerce platforms, there’s an acute need for backend solutions, analytics, quality assurance tools, and more.

Diversified Consumer Industries: It’s not just about fashion or electronics. The principles of recommerce can be extended to a myriad of industries, waiting for innovators to tap into them.

Key Take-away:

Recommerce isn’t just a trend – it’s reshaping retail’s future. With impressive growth stats and a clear investor appetite, startups have a clear signal to dive in and capitalize on this dynamic sector.

Challenges in the Recommerce Industry

It may sound cliche but every challenge is an opportunity for new innovators. These challenges need to be addressed for recommerce to be as streamlined as a regular ecommerce experience.

Also Read: eCommerce Trends and Challenges

Product Digitization

As World Retail Congress Chairman Ian McGarrigle says,

“Digitization is what allows brands to track the lifecycle of a product, which is a building block of the circular economy.”

The current infrastructure in many businesses may not be well-equipped to handle the digital aspect of products, making it challenging to effectively track the lifecycle of each item. The rise of the circular economy heavily relies on digitization to ensure products’ traceability and sustainability.

Traceability and Authentication

Authenticating products to ensure they are original and genuine is vital in this industry. Buyers want to be sure they’re getting what they pay for, especially when splurging on luxury or designer items. With the introduction of digital identities such as unique QR codes on items, there’s a growing expectation for items to be easily verifiable.

Logistical Issues

As the adage goes, ‘moving parts cause friction.’ Transferring products from sellers to buyers presents several logistical challenges.

While the buying process has been simplified through various apps and platforms, the selling process often remains convoluted.

Sellers have to go through numerous steps – from photographing and describing the item to managing offers and handling shipping. Simplifying this process is a critical challenge to address.

Cultural Barriers

Traditional business models have been built on the concept of producing and selling brand new items. Pivoting to or incorporating a recommerce model may clash with long-held company values and strategies, especially when factoring in concerns over planned obsolescence.

Safety and Quality

Especially pertinent in electronics, the assurance of product longevity and quality is paramount. Buyers need guarantees that the items they purchase, especially if pre-owned, will last and won’t have issues down the line.

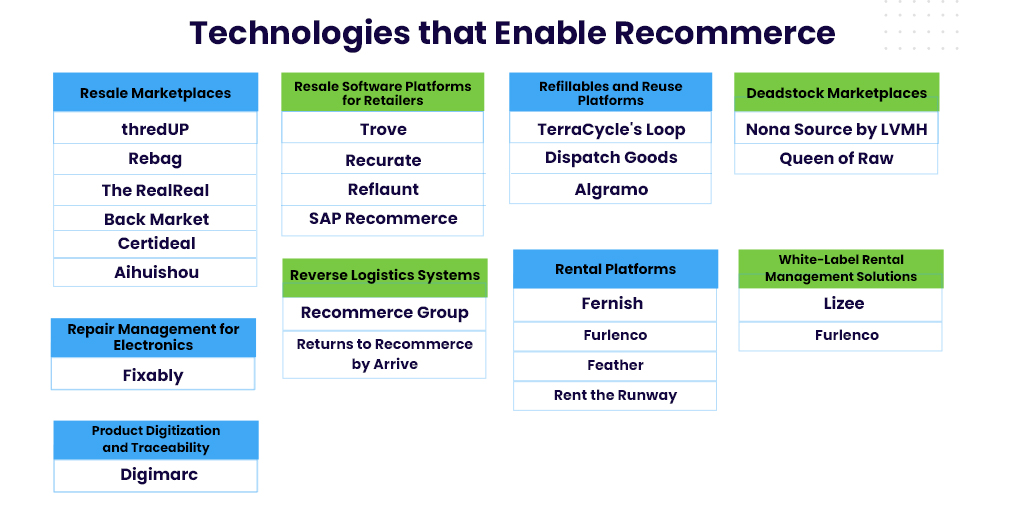

Tech Solutions That Enable Recommerce and Streamline the Resale Transaction

Thanks to evolving tech solutions, the resale market is becoming increasingly streamlined, efficient, and trustworthy for both sellers and buyers. Let’s dive into the technologies that have been pivotal in enabling this shift.

Recommerce Platforms or solutions basically fall in 2 categories: B2B and B2C.

B2C platforms are essentially marketplaces where customers can purchase second hand products directly.

Read More: How to Start a Online Store For Your B2C Business

On the other hand, B2B recommerce technologies provide the tools retailers need to create their own recommerce channel.

Let’s take a look at some technologies that are doing really well and are solving the challenges highlighted in the above section.

Resale Marketplaces

- thredUP: A resale platform where users can buy and sell secondhand clothing.

- Rebag: An online marketplace specializing in the resale of luxury handbags.

- Vinted: A platform where users can buy, sell, or swap pre-owned clothing and accessories.

- The RealReal: An online marketplace dedicated to the resale of pre-owned luxury apparel and accessories.

- Back Market: A platform focused on the resale of electronics, ensuring quality by rigorously screening its sellers.

- Certideal: A platform offering quality certified pre-owned devices.

- Aihuishou: A Chinese platform centered on the resale of various products.

Resale Software Platforms for Retailers

- Trove: Provides brands the infrastructure to run their own branded resale platforms.

- Recurate: Allows brands to offer resale services directly on their websites.

- Reflaunt: A resale-as-a-service platform that integrates buying and reselling functionalities on the same site.

- SAP Recommerce: Offers enterprise-grade tools for brands to encourage sustainable decisions and repurpose existing products.

- Sharpei: A sustainable fintech platform that empowers retailers and manufacturers to offer versatile purchasing options like try-before-you-buy, rentals, subscriptions, and second-hand reselling, seamlessly integrated into the checkout process.

Refillables and Reuse Platforms

TerraCycle’s Loop, Dispatch Goods, Algramo: Companies focused on reducing plastic waste by selling products in reusable packaging, thereby promoting a circular economy.

Deadstock Marketplaces

Nona Source by LVMH and Queen of Raw: Platforms that allow brands to sell unused fabrics and materials, emphasizing sustainability and waste reduction.

Repair Management for Electronics

Fixably: A software solution that offers an end-to-end platform for electronics repair businesses to streamline their operations.

Reverse Logistics Systems

Recommerce Group and Returns to Recommerce by Arrive: Companies that provide solutions for managing product returns, ensuring items are refurbished and resold in secondary markets.

Rental Platforms

Fernish, Furlenco, Feather, Rent the Runway: Businesses that focus on renting products rather than selling them, catering to changing consumer needs and emphasizing sustainability.

White-Label Rental Management Solutions

Lizee and Loopt: Platforms that enable brands to launch their own rental or resale operations, providing comprehensive logistical support.

Product Digitization and Traceability

Digimarc: Provides digital watermarking technology to embed discreet codes into products or packaging. This allows for unique digital identification and easy authentication of product authenticity.

The Need for Sustainability in Retail and Is It Really Sustainable?

Alarmingly, our current economy remains a mere 8.6% circular, revealing a significant Circularity Gap. This implies that to bridge the Emissions Gap by 2032, we need to elevate this by an additional 8.4%.

Statistics from the World Economic Forum shed light on the fast-paced evolution of the clothing industry. Over the past two decades, clothing production has approximately doubled. Comparatively, consumers in 2014 purchased 60% more garments than they did in 2000 but retained them for merely half the duration.

In raw figures, this translates to the disposal or incineration of clothing equivalent to a garbage truck’s content every second, as highlighted by the Ellen Macarthur Foundation.

Furthermore, the future forecast for electronic waste is daunting. By 2030, it’s anticipated to skyrocket to 74M metric tons, as delineated by the Global E-waste Monitor 2020.

Yet, the looming question remains: Is recommerce genuinely sustainable?

On the surface and logically, it is. By keeping a product in circulation, the carbon footprint of its associated incremental movements is decidedly less than producing a brand-new product or disposing of it.

But while this logic holds, its application warrants rigorous verification for each product type. As the SEC moves to initiate rules demanding companies to transparently report on their scope three emissions, we’ll undoubtedly observe a surge in these kinds of assessments. If there’s a possibility to validate emission reductions through specific actions, industries will naturally gravitate towards those practices.

Yet, sustainability isn’t just about the final product. It encompasses the entire production chain. Sourcing materials sustainably is as crucial as the final product’s disposability.

Often, a material may be environmentally sustainable at the disposal stage, but its transportation to production units might negate those benefits.

Sustainability Regulations

In tandem with consumer demand, regulatory bodies are ushering the transition to a more circular economy.

In July 2023, the European Commission unveiled a landmark proposal to revolutionize textile sustainability across the EU. Central to this initiative is the introduction of mandatory Extended Producer Responsibility (EPR) schemes for textiles. These schemes will mandate producers to cover textile waste management costs, incentivizing them to reduce waste and boost product circularity right from the design phase. Such measures are expected to promote the reuse and recycling of textiles, support second-hand markets, and kindle innovation.

Across the pond in the US, a pivotal move was made in 2021 when President Joe Biden signed an executive order. This order mandates federal agencies to devise regulations safeguarding the consumer’s right to repair electronic gadgets and other instruments. A directive that not only holds the promise of reducing electronic waste but also of prolonging product life cycles.

The Time to Act is Now

The path towards sustainability in retail is both urgent and multifaceted, fueled by consumer demands and stringent regulatory measures.

As our world grapples with closing the Circularity and Emissions Gaps, the responsibility on the retail sector is monumental. While we’ve made strides, the existing challenges underline the importance of immediate action. For brands, the message is clear: the time to act is now.

By embracing transparent practices, informed choices, and synergizing with regulatory frameworks, they can not only meet the demands of the present but also pave the way for a greener, more sustainable future.

The Future Landscape in Recommerce

What the future holds for recommerce? Here are some ideas.

Billion Dollar Opportunity for Startups

The recommerce arena provides an excellent opportunity for startups. With established brands often treading cautiously or unfamiliar with this new paradigm, budding entrepreneurs have a chance to innovate, bridging the gaps and introducing novel solutions.

Shifting Away from Mass Production Culture

Since the advent of the Second World War, a mass production culture has been prevalent. Recommerce offers the potential to move away from this, focusing on reusing and recycling, thereby minimizing wastage and promoting a more sustainable mode of consumption.

The Role of Livestream in Recommerce

Platforms are beginning to realize the power of real-time interaction and live shopping in building trust. As Morin notes, platforms like “eBay Live will create a sense of community, enabling buyers and sellers to interact with a live audience,” heralding a new era for recommerce.

Ease of Experience

For recommerce to truly take off, the selling and buying process must be as seamless as possible. This involves reducing complexities, ensuring transactions are secure, and making the experience enjoyable for the user.

Lowering Shipping Costs

One of the key challenges facing recommerce is the cost associated with shipping items. Economical shipping solutions will not only make the platform more attractive to sellers but will also encourage buyers to opt for pre-owned items.

Merging with Hyperlocal E-commerce

A synergistic relationship between recommerce and hyperlocal e-commerce could be the answer to logistical challenges. By focusing on local markets, we can reduce shipping distances and costs, making the process more efficient.

Also Read: Hyperlocal eCommerce – Tech Stack and App Features

Sustainability Assessments

For recommerce to be genuinely sustainable, there needs to be a rigorous assessment mechanism in place. Brands need to validate and regularly update the carbon footprint savings they claim from their recommerce initiatives.

Re-conceptualization of Products

The future of recommerce lies not just in reselling used products but in rethinking product design. Concepts like reusable containers challenge traditional notions of product ownership and usage, indicating broader horizons for recommerce.

Conclusion

Recommerce stands at the intersection of sustainability and commerce, offering myriad benefits from conserving resources to providing economical alternatives. However, for it to realize its full potential, both consumers and brands must address existing challenges and be adaptive to the changing retail landscape. The future beckons with promise, but the onus is on us to pave the path ahead.

References:

https://static.ebayinc.com/assets/Uploads/Documents/eBay-Recommerce-Report-Highlights-2022.pdf

https://us1.campaign-archive.com/?u=0c60818e26ecdbe423a10ad2f&id=02f85b2a0c

https://www.cbinsights.com/research/etsy-buys-depop/

https://www.cbinsights.com/research/report/sustainable-retail-tech-circular-economy/

https://www.recommerce100.com/

https://ec.europa.eu/commission/presscorner/detail/en/ip_23_3635