B2B eCommerce Growth Trends in 2026 for Manufacturers

Smyrna Truck had been operating for decades, thriving on long-standing dealer relationships and traditional offline workflows. For years, that formula worked. But then something shifted.

A wave of new, digitally native manufacturers entered the market – companies with sleek websites, 24/7 online ordering, real-time inventory, self-serve quoting, and automated dealer portals. Smyrna Truck began losing business to companies that were actively capturing the growth trends in B2B eCommerce for manufacturers. It was then they realized that opportunity cost of not modernizing their sales process could cost them their business.

This blog will highlight what that opportunity cost is in B2B eCommerce for Manufacturers and what are some major B2B eCommerce growth trends that are causing a shift in the B2B landscape.

2026 Statistics of B2B eCommerce Growth Trends for Manufacturers – What’s Changing?

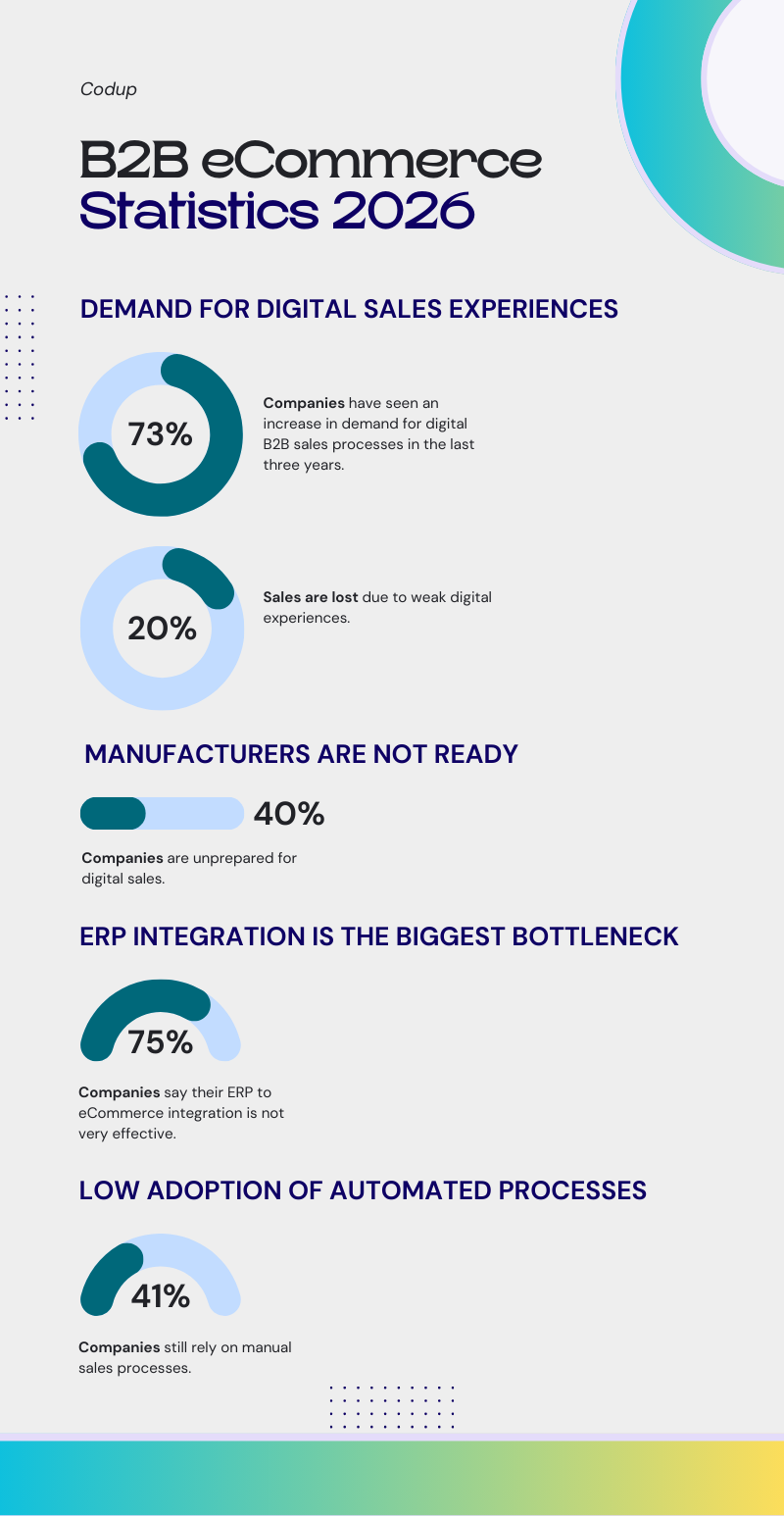

The data is clear: B2B eCommerce for manufacturers is accelerating at a pace that legacy workflows simply can’t keep up with. And while demand grows, most manufacturers aren’t prepared—creating a widening gap between buyer expectations and seller capabilities. That gap is the opportunity cost.

Here’s what the numbers reveal about what manufacturers gain by modernizing—and what they lose by delaying:

1. Demand for Digital Manufacturing Sales Is Rising Fast

- 73% of companies have seen an increase in demand for digital B2B sales processes in the last three years.

- 14% report this increase as significant, led by younger procurement teams and global supply chain pressures.

Opportunity cost:

Manufacturers who maintain email- or spreadsheet-based ordering risk losing buyers who now prefer instant, digitally enabled purchasing.

2. Most Manufacturers Are Not Digitally Ready

- Only 20% feel very prepared for the future of digital B2B sales.

- 41% feel somewhat prepared, leaving nearly 40% openly unprepared.

Opportunity cost:

Competitors become the default choice simply because they offer a frictionless, modern buying experience—regardless of product superiority.

3. ERP + eCommerce Integration Is the Biggest Bottleneck

- 75% say their ERP-to-eCommerce integration is only “somewhat effective.”

This means incorrect pricing, delayed quotes, inaccurate availability, and manual workarounds.

Opportunity cost:

Every integration gap creates frustration—lost quotes, delayed orders, and dissatisfied dealers who quietly move their spend elsewhere.

4. Automation Adoption Is Split

- 50% have automated most buying touchpoints, such as approvals, replenishment, and pricing.

- 47% still rely heavily on manual processes.

Opportunity cost:

Manual steps slow down sales cycles, increasing the risk of abandoned RFQs and buyers choosing manufacturers who respond faster.

5. Poor Digital Buying Experiences Directly Reduce Revenue

- Companies estimate 20.9% of potential sales are lost due to weak digital experiences.

That’s not a small number—manufacturers often operate on tight margins, and a 20% leakage can erase entire product lines’ profitability.

Opportunity cost:

Manufacturers aren’t just losing leads—they’re losing long-term dealer relationships and repeat buying cycles.

Delaying Digitization Is Now the Most Expensive Strategy

The statistics all point to one truth:

Every year manufacturers delay digital transformation, the cost of inaction compounds with buyers quietly defecting to more modern competitors.

Focus Areas to Invest in to Capitalize B2B eCommerce Growth for Manufacturers

Capitalizing on the explosive growth in B2B eCommerce for manufacturers requires focused investment in the capabilities that directly influence how buyers research, evaluate, and place orders.

The following focus areas highlight where forward-thinking manufacturers are investing to drive growth, reduce friction, and protect market share in an increasingly competitive B2B landscape.

1. Rep-Lite, Self-Serve Buying Experience

Millennial and Gen Z buyers now drive most B2B purchasing decisions—and they prefer independence over constant back-and-forth with a sales rep. That’s why we’re seeing a strong shift toward self-serve portals where buyers can:

- Log into an account-based dashboard

- See their contract pricing and custom catalogs

- Check real-time availability

- Reorder from past orders in a few clicks

- Track orders and invoices without emailing anyone

For manufacturers, self-service essentially means “give dealers and procurement teams everything they need to buy without calling us.”

2. Advanced Analytics and AI Powered Personalization and Forecasting

Manufacturers are sitting on years of order history, quote data, and product performance—but historically, very little of it has been used intelligently.

That’s changing. Leading manufacturers are investing in:

- Advanced analytics to understand account behavior, margin by segment, and product velocity

- Predictive demand forecasting to optimize stock levels and production planning

- AI-driven personalization to recommend relevant SKUs, bundles, or accessories to each account

- Hyper-personalization at the decision-maker level (not just at the account level), based on role, past behavior, and region

In practice, this looks like portals that know which spare parts a plant will likely need next, or which consumables a dealer should reorder before they run out.

Manufacturers can use these tools to grow their high value accounts and double their revenue.

3. Deep Integration and Automation Across the Sales Stack

The days of eCommerce living in a silo are over. When ERP to eCommerce integrations are weak or non-existent, buyers see wrong prices, outdated inventory, and slow order confirmations. That’s exactly the kind of friction that sends them to more integrated competitors.Growth in B2B eCommerce for manufacturers is coming from companies that connect:

- ERP (inventory, pricing, availability)

- CRM (accounts, opportunities, contacts)

- eCommerce / dealer portal

- 3PL or WMS (warehousing and fulfillment)

- CPQ tools for complex configurations

This integration enables automation across touchpoints: automatic price breaks, contract pricing, credit limits, approvals, tax/VAT handling, and invoicing—without manual re-entry.

4. Omnichannel and Marketplaces

Industrial buyers aren’t discovering products in just one place anymore. They might:

- Discover a new supplier on an industry marketplace

- Shortlist options via social or search

- Compare specs on your website

- Submit a quote via a portal

- Finalize details with a rep via email or Teams

Manufacturers need to be listed on B2B marketplaces like Amazon Business, vertical industrial marketplaces, and distributor portals.

To make it easier for channel partners to work with, they need to ensure consistent product data, pricing logic, and availability across all channels

5. Mobile-First and Real-Time Transparency for Field Buyers

A growing share of B2B activity now happens in the field: maintenance teams on the shop floor, contractors on job sites, technicians in service vans. They expect to:

- Check availability and lead times on their phone

- Place or approve orders from a mobile device

- Access installation guides, spec sheets, and documentation on the go

Manufacturers need to respond with mobile-optimized portals and apps that provide real-time inventory and ETAs.

6. Rich Digital Content and Hybrid Engagement

B2B buyers are doing most of their research before they ever talk to a rep. That’s pushing manufacturers to level up their digital content and engagement:

- Detailed spec sheets, CAD files, and installation guides

- Application notes and configuration guides

- Video demos, how-tos, and field use cases

- Case studies and review content for social proof

Sales no longer owns the entire buyer conversation—content, marketing, and digital teams now share that responsibility.

If your portal is just a price list with “Add to cart,” you’re forcing buyers to hunt for critical information elsewhere—and often, that “elsewhere” is a competitor.

7. Sustainability, Compliance, and Data

Sustainability is no longer just a consumer trend. Industrial buyers are under pressure from regulators, corporate sustainability goals, and their own customers to select suppliers that help them meet ESG targets.

Manufacturers need to use their B2B eCommerce experiences to surface:

- Environmental certifications and compliance data

- Material sourcing transparency

- Energy efficiency or lifecycle impact of products

8. Composable and API-First Architectures for Future Flexibility

Finally, leading manufacturers are moving away from monolithic, rigid platforms and toward composable, API-first architectures. Instead of one massive system doing everything poorly, they’re assembling:

- Best-of-breed components (PIM, CPQ, search, pricing)

- Connected via robust APIs

- Orchestrated through a middleware or integration layer

This makes it far easier to add new channels, launch new brands, experiment with marketplaces, or layer in new capabilities like AI without “replatform everything” projects every few years.

9. Integration With Buyer Systems

One of the strongest growth levers in B2B eCommerce for manufacturers is the ability to integrate with your clients’ systems from EDI connections to procurement platforms or distributor portals.

These connections allow buyers to pull updated pricing, availability, and order history directly into their own workflows, creating a frictionless experience that’s nearly impossible for competitors without integrations to replicate.

The result is automation at scale, reduced errors, and greater personalization across every touchpoint.

Conclusion

B2B eCommerce for manufacturers is no longer an emerging opportunity—it’s the new competitive baseline. As buyers adopt digital-first habits, expect real-time information, and demand frictionless self-serve experiences, the gap between digitally mature manufacturers and those relying on legacy workflows continues to widen.

The data in this blog shows a clear pattern: organizations that invest in modernization—integrated systems, automation, advanced analytics, AI, and buyer-centric portals—are capturing market share, accelerating sales cycles, and strengthening customer loyalty.

Hire Codup for B2B eCommerce consulting.